All Categories

Featured

Table of Contents

[/image][=video]

[/video]

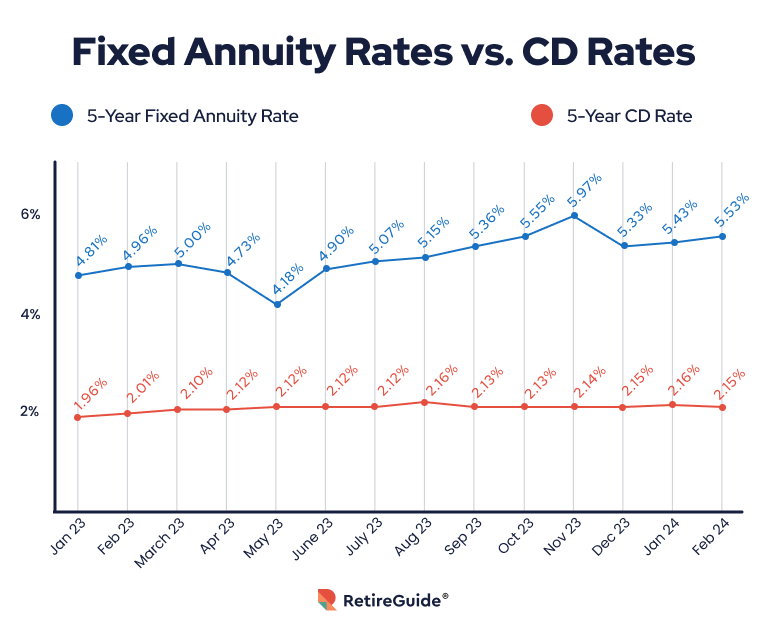

The landscape is moving. As rate of interest decline, taken care of annuities may shed some appeal, while items such as fixed-index annuities and RILAs gain traction. If you remain in the market for an annuity in 2025, shop carefully, contrast options from the best annuity companies and prioritize simpleness and transparency to find the appropriate suitable for you.

When picking an annuity, financial strength ratings issue, however they do not tell the entire story. Here's exactly how contrast based on their scores: A.M. Finest: A+ Fitch: A+ Standard & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A.M. Ideal: A+ Moody's: A1 Criterion & Poor's: A+ Comdex: A greater economic score or it only shows an insurance firm's financial toughness.

If you concentrate only on rankings, you may The finest annuity isn't just about firm ratingsit's around. That's why comparing actual annuity is much more vital than just looking at economic toughness scores.

That's why it's vital to obtain advice from somebody with experience in the sector. is an staffed by independent accredited financial professionals. We have years of experience helping individuals locate the appropriate products for their demands. And due to the fact that we're not connected with any company, we can give you honest suggestions regarding which annuities or insurance coverage are ideal for you.

We'll aid you sort with all the options and make the most effective decision for your scenario. When choosing the best annuity business to recommend to our customers, we employ a comprehensive approach that, after that from there that includes the adhering to standards:: AM Ideal is a specialized independent score agency that assesses insurance policy companies.

, there are many alternatives out there. And with so lots of choices, knowing which is ideal for you can be difficult. Go with a highly-rated firm with a solid reputation.

Rmd Variable Annuity

Select an annuity that is easy to comprehend and has no gimmicks. By following these guidelines, you can be certain you're obtaining the best possible offer on a fixed annuity.: Oceanview Annuity due to the fact that they often tend to have higher passion prices with basic liquidity. ("A" rated annuity firm): Clear Springtime Annuity due to the fact that they are uncomplicated, solid annuity prices and basic liquidity.

Some SPIAs provide emergency liquidity features that we like.

There are a couple of crucial variables when searching for the best annuity. Contrast passion prices. A higher passion rate will certainly use more development potential for your investment.

This can promptly improve your investment, however it is vital to recognize the terms affixed to the reward prior to investing. Lastly, think concerning whether you desire a life time income stream. This kind of annuity can give tranquility of mind in retired life, but it is vital to ensure that the revenue stream will be ample to cover your requirements.

These annuities pay a fixed regular monthly amount for as lengthy as you live. And also if the annuity runs out of cash, the regular monthly repayments will certainly proceed originating from the insurer. That means you can relax very easy knowing you'll always have a consistent income stream, despite how much time you live.

Life With Refund Annuity

While there are numerous various kinds of annuities, the best annuity for long-term treatment costs is one that will pay for many, if not all, of the costs. There are a couple of things to take into consideration when selecting an annuity, such as the size of the agreement and the payout alternatives.

When picking a set index annuity, contrast the readily available products to find one that ideal suits your demands. Athene's Performance Elite Collection American Equity AssetShield Series Athene Dexterity Fixed Indexed Annuity is our top selection for tax obligation deferment for numerous reasons. Enjoy a lifetime income you and your partner can not outlive, supplying monetary protection throughout retired life.

Global Atlantic Annuity Contact

On top of that, they allow as much as 10% of your account value to be taken out without a fine on the majority of their item offerings, which is more than what most other insurer enable. One more consider our referral is that they will certainly enable senior citizens as much as and consisting of age 85, which is likewise greater than what a few other business enable.

The best annuity for retirement will certainly depend on your individual requirements and purposes. A suitable annuity will give a steady stream of revenue that you can rely on in retirement.

Athene Index Annuity

Finally, an appropriate annuity should also give a fatality benefit Your loved ones are cared for if you pass away. Our referral is. They are and consistently use several of the greatest payments on their retired life revenue annuities. While prices fluctuate throughout the year, Integrity and Guarantee are normally near the leading and maintain their retirement revenues competitive with the various other retirement earnings annuities out there.

These rankings provide consumers an idea of an insurance provider's financial stability and how likely it is to pay on cases. It's crucial to note that these ratings don't necessarily mirror the quality of the products used by an insurance company. For instance, an "A+"-rated insurer can offer items with little to no growth capacity or a lower income permanently.

After all, your retirement savings are most likely to be one of the most vital financial investments you will ever before make. That's why we only recommend collaborating with an. These companies have a tried and tested track document of success in their claims-paying ability and offer lots of features to help you satisfy your retired life goals."B" ranked companies need to be avoided at nearly all expenses. If the insurer can not achieve an A- or better ranking, you need to not "wager" on its skills long-lasting. Surprisingly, lots of insurance provider have been around for over 50 years and still can not achieve an A- A.M. Finest score. Do you wish to gamble cash on them? If you're seeking life time income, adhere to guaranteed revenue cyclists and avoid performance-based revenue motorcyclists.

Table of Contents

Latest Posts

Annuity Inflation

Security Benefit Annuities

Fixed Annuity Safe

More

Latest Posts

Annuity Inflation

Security Benefit Annuities

Fixed Annuity Safe